Compounding is the 8th wonder of the world. Imagine you planted a tree years ago, The first day there will be only one leaf, the next week one leaf split into two and then the third week the two leaves split into four and so on. After sometimes it became a big tree and covered with full leaves. Compounding is something like that. In this blog, we will learn about What is Compounding ?

Compounding can transform small efforts into extraordinary results over time. Whether it’s money, knowledge, skill, relationship etc. consistent compounding can lead you to exponential growth. There are two major things that affect compounding.

1. Time

2. Patience/consistency.

The power of Compounding

Compounding is the process of earning returns on your returns. Compounding is a way that money can grow over time. It’s like a snowball rolling down a hill, getting bigger and bigger.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Albert Einstein

Here’s how it works:

- You put some money away, like in a savings account.

- That money earns some extra money, called interest.

- Now, here’s the important part: the interest gets added to the original money.

- So, the next time interest is calculated, it’s based on the new, higher amount.

Let’s take a simple example of money

Compounding work in Stock-Market. Suppose you have invested, 100000, and you earned 10% interest from it per year. After completing the first year you will have 110000. The first 100000 you invested and the 10000 interest you earned and become 110000. And if you invest that money for the next one more year. That amount will become 121000. In this year you earned interest not just, 100000 but also on 10000. If you continuously invest that money, your money grown at an accelerating rate.

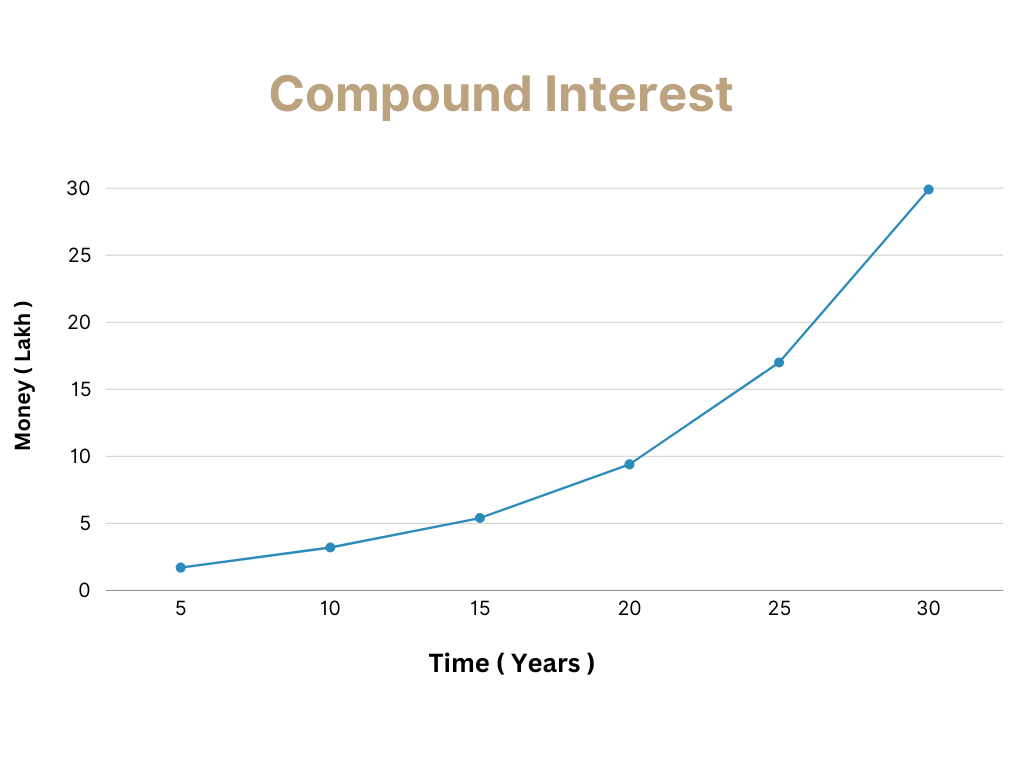

At the starting stage the difference seems very small, but after a long period of time like 10, 20, 30 years the difference will be exponential. The more time you invested, the difference will be bigger. And that is the power of compounding.

What is Compounding ? How It Works

It’s essential to understand how compounding works to make the most of your savings and investments. Here’s a simple, step-by-step explanation:

Step 1: Your journey starts with the principal amount, which is the money you first invest or save.

Step 2: The Interest Rate (p.a.) is the annual percentage at which your principal amount increases.

Step 3: The interest is calculated on the principal amount for a specified period of Time.

Step 4: The interest earned is added to the principal amount, making the new principal amount. This process is repeated, with the interest rate applied to the new principal amount.

Step 5: The process is Repeated for each subsequent period, with the interest rate applied to the new principal amount. This creates a cycle of growth, where your money earns interest on interest. This process called compounding.

| Years | Your Contribution | Compound Interest (P.A.) | Interest Earned | Total Value |

| 1-5 | 100000 | 12% | ₹76,234 | ₹1,76,234 |

| 5-10 | 100000 | 12% | ₹2,10,585 | ₹3,10,585 |

| 10-15 | 100000 | 12% | ₹4,47,357 | 5,47,357 |

| 15-20 | 100000 | 12% | ₹8,64,629 | ₹9,64,629 |

| 20-25 | 100000 | 12% | ₹16,00,006 | ₹17,00,006 |

| 25-30 | 100000 | 12% | ₹28,95,992 | ₹29,95,992 |

Compounding Key Factors

Here’s a step-by-step guide to understanding the key metrics of compounding:

Principal Amount– It is your Saving/Initial money to start compounding.

Interest Rate– The interest rate is the percentage at which your money grows over time. A higher interest rate means your savings or investments will grow faster, while a lower rate means slower growth. It’s a key factor in determining how quickly your money can double or multiply.

Time– This is the most important factor in compounding. The longer you let your money stay invested, the more compounding show their magic. Even small amounts can turn into significant sums over time.

Frequency of Compounding– This refers to how often the interest is added to the principal (e.g., annually, quarterly, monthly).

How These Metrics Impact Compounding:

- Principal Amount: Starting with a larger sum means a bigger foundation for compounding. The more money you start with, the more your interest will add up over time.

- Interest Rate: A higher interest rate makes your money grow faster because it earns more on both the principal and the interest already accumulated.

- Time: Compounding becomes more powerful over time. The longer you leave your money untouched, the greater the effect of compound growth.

- Frequency of Compounding: Compounding more frequently means your interest is calculated and added to the principal more often, which accelerates growth.

Common Mistakes to Avoid

Compounding is a powerful thing. If you do some mistake, your compounding growth can go slow down. Here are some mistake to avoid :

❌ Starting Late– If you start late, your compounding effects are very slow.

❌ Not Investing Consistently– Your regular contribution can maximize compounding effects.

❌ Withdrawing Money Too Early– Compounding needs patience to show its effects, if you withdraw money early, It can effect compounding effects.

❌ High Fees– Do not invest in such assets that have very high fees before investing. It can effect long-term compounding effects.

Conclusion:

Compounding is a very powerful tool to unlock your Financial-growth, Knowledge and Health to the next level. The best time to start compounding was yesterday. The second-best time is today!. So start you your journey as soon as possible. I hope my blog “What Is Compounding” is to help you in some way. If you have any suggestion, please leave a comment below so we can improve and make knowledge content for our viewers. If you have any queries then you can Contact us page.

Wow what a information

Great

I like it